AI-Enabled Decentralized Finance Network

A thorough AI-enabled DeFi system featuring an open-source language model and trading algorithms

NEWS LiSTS

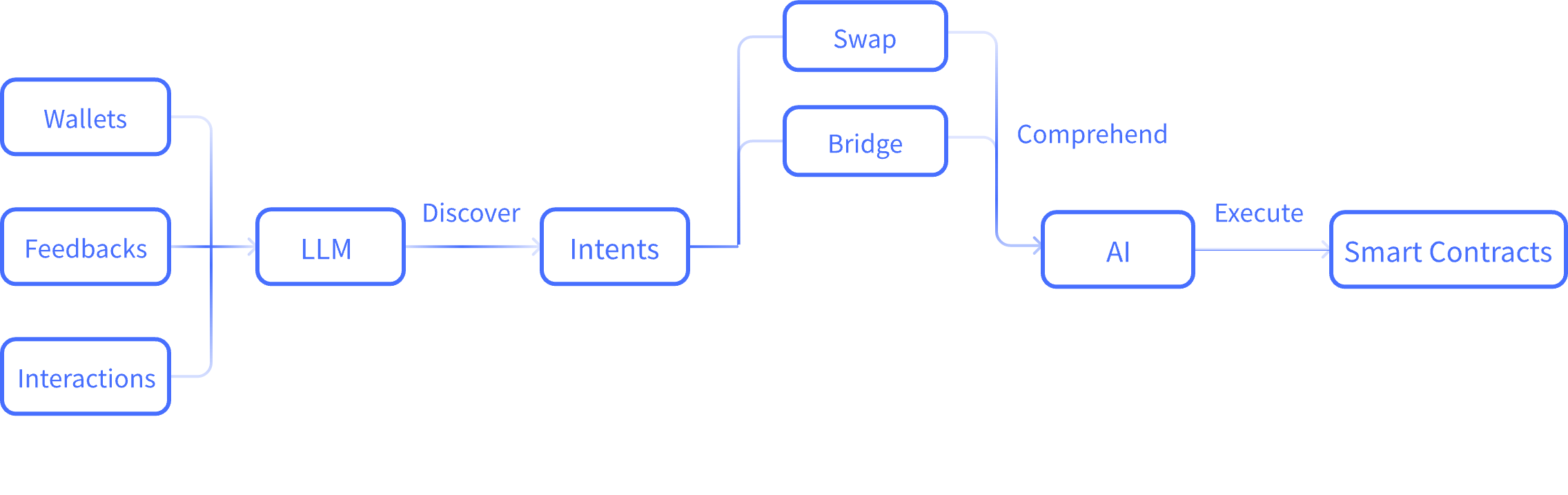

AI-Driven Optimization of Trading Routes

0xGen, leveraging AI technology within its DeFi platform, provides superior pricing and minimizes slippage through advanced AI algorithms, and integrates with premier DEX aggregators. It evaluates active aggregators to determine the most effective trading route, optimizing prices with its AI capabilities.

Publicly Available Infrastructure

0xGen has open-sourced its AI algorithms and LLM, welcoming developers to collaborate on both training and application. They also offer an easy-to-implement swap widget and SDK, which enables developers to integrate 0xGen’s swap functionality within an hour. With these resources, developers can seamlessly integrate our AI algorithms and LLM into their applications, empowering them with sophisticated language processing capabilities. Additionally, developers can quickly access all the features of 0xGen, including swaps, cross-chain swaps, trading signals, and more, to build upon.

We support the following mainnets: Ethereum, BNB Chain, Solana, Polygon, Avalanche, Fantom, Arbitrum, Optimism, Aurora, Terra, Gnosis, Boba, Ontology, Tron, Heco, OKC, Zksync, Linea, Cronos, and Scroll.

Our active aggregators include 1inch Network, OpenOcean, Matcha, and Jupiter Aggregator.

Cryptoeconomics

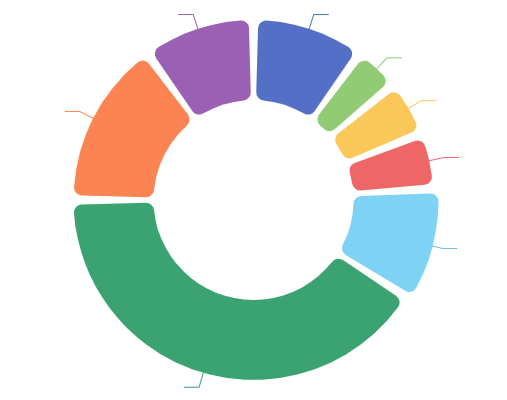

"Of the rewards, 41% is reserved for community initiatives: 10% for staking (released linearly over 5 years), 10% for contributors like ecosystem partners (25% unlocked per quarter), 15% for system incentives (released linearly over 5 years), 3.4% for community events (unlocked linearly over 42 months), 0.1% for OGs (released at TGE), and 2.5% for trade-to-earn (unlocked over 6 months). The team is allocated 15%, with 16.67% unlocking every six months, and the entire amount released in 3 years. 10% is dedicated to AI model development and maintenance, with a linear release over 5 years. The treasury holds 10%, unlocking 12.5% every quarter. The private round allocates 10%, with 20% at TGE, a 3-month cliff, and 6.67% monthly release. Investors receive 5%, with 20% at TGE, a 3-month cliff, and 5% released monthly. The IDO portion is 5%, released fully at once.""